Supplementary Learning

More Financial, Dairy, Grain and Livestock Learning

Profit Even More Here

Optional Supplementary Learning Page

This is our optional supplementary learning page. Here you can view tips about a variety of conventional dairy, grain and livestock subjects. You’ll also find a variety of topics to improve the financial aspects of your operation too.

These resources are optional and not required to complete your On-Line Learning Module coursework!

Start Learning About The Importance of Farm Financial Aspects To Your Operation. Select The Category.

Understanding and utilizing farm records is one of the most critical activities that a producer can undertake. Farm records are the result of every decision that the producer made. Putting them together in organized financial statements helps the producer know where to look to identify issues.

But, in order to utilize the information the farm generates to your advantage, you have to understand HOW to put these statements together and HOW to interpret them. Here, we have videos and hands-on examples to help producers put together and understand the information that comes out of their records.

Balance Sheets

The balance sheet is an essential tool used by farmersto understand the current financial health of a business. It is generally used alongside the two other types of financial statements: the income statement and the cash flow statement.

Ag Finances

Balance Sheet Foundations

In this Video, Curtis Mahnnken from the University of Minnesota and the Center for Farm Financial Management, tune in to learn more about how balance sheets work, when they should be completed, and some of the financial analysis that could be done as a great benefit to your operation.

Ag Finances

When To Prepare a Balance Sheet

In this Video, Curtis Mahnnken from the University of Minnesota and the Center for Farm Financial Management, learn the importance of when you should compile your operational balance sheet, and why it should be done on a regular schedule.

Ag Finances

Balance Sheet Structure

Here, Curtis Mahnnken from the University of Minnesota and the Center for Farm Financial Management, asks why you would need to create a balance sheet for your operation. Stay tuned to for helpful insight on the structure of your balance sheet, and what insights you can derive from it.

Ag Finances

Current Assets

Current assets is the topic Curtis Mahnnken from the University of Minnesota and the Center for Farm Financial Management focuses on, describing what current assets could be within your operation. This is an important concept to understand in the overall process of constructing your balance sheet.

Ag Finances

Diving Into Current Assets

Curtis Mahnnken from the University of Minnesota and the Center for Farm Financial Management, digs into a little more detail on the topic of current assets. This includes a wide variety of items within your operation, take notes to make sure you don’t miss out on this information!

Ag Finances

Intermediate and Long Term Assets

In this Video, Curtis Mahnnken from the University of Minnesota and the Center for Farm Financial Management, covers further in depth on the topic of assets. After reviewing current assets, tune in to this video to better understand what intermediate and long term assets could be for your operation.

Ag Finances

Assets Valuation

Here, Curtis Mahnnken will help you understand how to approach a great challenge in asset valuation. For current assets a current market value would suffice, but how do you figure this for intermediate and long-term assets? Click here to find out!

Ag Finances

Current Liabilities

In this Video, UMN’s Curtis Mahnnken and the Center for Farm Financial Management, covers the opposite side of your balance sheet, liabilities. These could vary from a great many things, stay tuned to learn more about liabilities and the impact they have on your balance sheet.

Ag Finances

Loans

In this Video, Curtis Mahnnken from the University of Minnesota and the Center for Farm Financial Management, helps you understand how to handle and include loans in your balance sheet should you face some challenges.

Ag Finances

Intermediate and Long Term Liabilities

Here, Mahnnken touches further on the structure of your balance sheet, and how your operation would be financed. These typically include loans that would provide your operating cash, machinery, and other requirements for your operation.

Ag Finances

Net Worth

In this Video, UMN’s Curtis Mahnnken from and the Center for Farm Financial Management, informs you how to calculate the total net worth of your operation. Using the knowledge you’ve gained through these videos so far, how do you think this would be done?

Ag Finances

What Is Depreciation

Here, we cover a big cost value topic, depreciation. While this is not a cost that you pay out of your check book every year, it is a real cost to your operation and is certainly something you should understand.

Ag Finances

How Do We Handle a Hedging Account

Curtis Mahnnken from the University of Minnesota, goes over what a hedging account is, what you can do with it, and the benefits that come along with it. Stay tuned to learn how this risk management option might work for your operation.

Ag Finances

What Are Deferred Liabilities

In this brief Video, Curtis Mahnnken from the University of Minnesota and the Center for Farm Financial Management, covers the topic of deferred liabilities. These would include some liabilities or expenses that could occur within the dissolution of your operation.

Ag Finances

Balance Sheet Recap

In our final video of the sector, Mahnken wraps a nice bow on the topic of balance sheets. After this recap you should be ready to make your own balance sheet, and plant a firm understanding on your operations finances. Thanks for tuning in!

Income Statements

An income statement is one of the three—along with balance sheet and statement of cash flows—major financial statements that reports a farms financial performance over a typical year.

Net Income = (Total Revenue + Gains) – (Total Expenses + Losses)

Ag Finances

Income Statement Foundations

Income statements are the summary of your revenues and expenses that occured during a given year. It can tell you your net farm income, and your return regarding labor and management, and also offer comparisons.

Ag Finances

Why Analyze My Farm

Farmers must look at their farm as a business. That’s why you need to understand what is going on in your business from a financial standpoint. You need to not only know how you did for the year, but also how you can do better next year.

Ag Finances

Income Statement Basics

It’s all about profit in the income statement. There three types of income statements: cash, accrual adjusted or accrual. In this video you will learn the ins and outs of the three types of statements, and why you may want to consider using the accrual method.

Ag Finances

Accrual Income Statements

Here, you’ll go into detail about the Accrual method of compiling an income statement. This method is a better way to understand your farm’s profitability. There can be swings between times of the year when you purchase something, compared to when you will actually use it.

Ag Finances

Actual Income Statement Example

This video gives an example of two farms, compared with an Accrual income statement. One farm factors in remaining crop inventory at the end of the year, compared to the beginning. An accrual method gives you a much better picture compared to a cash income statement.

Ag Finances

Cash Versus Accrual

You may feel like you need advanced accounting training to adopt the accrual accounting method. But you don’t! You can produce an accrual income statement without using accrual accounting. View this video for the secret.

Ag Finances

Income Statement Construction

Cash income is the place to start. Next, there must be adjusted revenue. Then, you address direct expenses and separate them from overhead expenses. After compiling these, you are getting closer to having a business indicator of how you are doing.

Ag Finances

What If I Don’t Have Detailed Records

If you don’t have enough detailed records, there is a Schedule F tax tool from the Center for Farm Financial Management that can help you. Find it here: https://www.cffm.umn.edu/wp-content/uploads/2020/05/How-Schedule-F-Income-Is-Determined-in-FINPACK.pdf

Ag Finances

Income Statement Recap

In this wrap-up for the income statement section, major take-aways are examined. The income statement only measures what you earn and what you spend. It’s a map to what happened during the given time perios the statment covers.

Introduction to Cash Flows

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows a farm receives from its ongoing operations. It also includes all cash outflows that pay for farm-business activities and investments during a given period.

Ag Finances

Cash Flow Components

Cash flow components include inflows, which factor in income and sales, and outflows covering expenses and purchases. Think about your plans for the year, include marketing stored inventories and new production. Then consider inputs and major purchases too.

Ag Finances

Cash Flow Considerations

Base your plan by considering historical production records, prices and past expense levels. Do your best to project major expenses, like fuel and other inputs. Are your cash flow needs quarterly, annually or monthly?

Ag Finances

Budgets

With cash flow planning, it’s important to keep in mind that life happens, and you can make changes going forward in the year. Some tools can take into account your budget and create cash flows for the year. Cash flow planning can use Enterprise or Whole Business budgets.

Pulling It All Together

It’s time to assemble all the knowledge you’ve gained from the other major financial learning sectors and put it to work for the benefit of your farming business. Take a look at these final videos.

Ag Finances

Evaluating Your Business

Preparing the four types of individual farm statements is an important foundation that allows you to move to the next step. Evaluating your entire business. You are attempting to better understand where you are, where you have been and where you are going.

Ag Finances

Preparing For a Loan Request

Agriculture is a capital intensive business, and visiting with your lender can make you pretty nervous. But preparation is truly important. Make sure you take three years worth of tax returns, your financial statements and your action plan for your farm.

Ag Finances

The 5 Cs Of Credit

Your lender is assessing the credit worthiness of you and your operation when loan time comes. He will factor character, capital, conditions, capacity and collateral to make judgements about whether he can approve your credit line.

Supplementary Dairy Learning Modules

Read these documents to learn more about dairy production

On-Farm Culture: Smart Approach to Clinical Mastitis Treatment

On-farm culturing allows for more informed decisions to be made regarding treatment and can help answer questions about whether to treat a quarter or not.

Consider More Than Days of Age When Weaning Calves

For many operations the decision to wean calves is based solely on age. If calves are experiencing growth slumps, the transition period may need some changes.

Dairy Sense: Keeping the Dairy Right Sized

Regardless of the dairy’s herd size, there is one key theme that applies to everyone, a land base that matches the number of cows and heifers in the herd.

Dairy Sense: Facing Financial Angst In Good and Bad Times

A good record keeping system and chart of accounts goes a long way to empower producers to in learning their breakeven costs.

Hybrid Testing Reveals Dairy Corn Silages Can Be Compared

Results for NDF and starch digestibility yield discussion about the impact of corn silage in rations for dairy cattle.

Ventilation Systems, Efficiency, and Maintenance for Dairy Housing

Well-built and efficient fans and maintenace goes a long way in helping to achieve ventilation needs while keeping energy costs in check on the dairy.

Dairy Sense: Small Grain Silage for the Lactating Herd

Double cropping corn silage acres with a small grain is a strategy that provides additional forage inventory and maintains cover on fields, reducing sediment and nutrient loss.

Dairy Sense: Getting Lost in the Minutia Can Be Counter-Productive

Trouble shooting herd problems can be very challenging and difficult. Take the big picture approach to solving problems. Alternate moves can create ripple effect.

Dairy Sense: Home Raised Feed Costs vs. Market Costs

Costs associated with the cropping enterprise are extremely important. Accounting for all the expenses needs to be included to accurately determine the bottlenecks to profitability.

Controlling the 4C's: Crops, Cows, Cash and Conservation

In today’s economic climate profitable farms target management practices on crops, cows, cash and conservation or the 4C’s. People often ask if there are commonalities, such as super forage quality or high milk production.

Supplementary Grain Learning Modules

Read these documents to learn more about grain production

Estimating Grain Transportation Costs Important For Farmers

Marketing grain involves making decisions about when to sell, how to sell, and where to sell. With the increased availability of ethanol plants, feed mills, barge loading facilities, and grain processors, farmers have many choices for a selling location.

Stored Grain Insect Pest Management Important to Profits

Direct-feeding damage by insects reduces grain weight, nutritional value, and germination of stored grain. Infestations also cause contamination, odor, mold, and heat-damage problems that reduce the quality of the grain and may make it unfit.

Grain Storage Aeration Is Important For Farmers To Contain Losses

Estimated annual grain loss from harvest to consumption is approximately 10 percent of total production. About half the loss occurs during harvest; the remainderin storage. These losses can be reduced if proper procedures are followed by producers.

Basic Soil Health Test Kit Manual From Rodale Institute

This manual addresses measuring soil pH, nitrates, phosphates, and sulfates. It also covers estimating water infiltration rate, water holding capacity, and soil pH, nitrate, phosphate, and sulfate content.This is a guide accompanying a kit.

Calculating the Value of Manure for Crop Production

This Nebraska guide provides criteria and guidelines to determine the market value of manure for crop production. Manure does not supply nutrients ih balance with crop needs, but has the value of slowly releasing nutrients, minimizing nitrate leaching.

The Cost of Storing Grain to Help Producers Maximize Profits

The availability of storage adds flexibility to a grain marketing program. Storage enables the producer to use marketing tools that capture seasonal price increases and/or narrower basis levels following harvest.

Storage can increase a producer’s income.

Important Considerations for Farm Machinery Selection

Putting together an ideal machinery system is not easy. Equipment that works best one year may not work well the next because of changes in weather conditions or crop production practices. Improvements in design may make older equipment obsolete.

Grain Storage Alternatives: An Economic Comparison

Grain prices tend to be higher later in the marketing year than at harvest. Storing grain can help you capture the carry in the market. Flexibility in where and when grain is sold can also be maintained. Harvesting progress faster if grain doesn't have to be delivered off-site.

The Five Soil Health Principles That Demand Your Attention Now

Healthy soils have a protective surface layer of plant residue to control soil temperature and reduce evaporation. This maintains a favorable environment for soil biology. You can preserve residue to keep soil covered by leaving crop residues in the field.

Managing Soil Health: Why You Need to Pay Attention

The overall goal of a soil health management program is to balance nutrient inputs and outputs and ensure a good balance of nutrients for the crop. It requires a mix of proper tillage, irrigation, crop residue and weed management.

How to Operate a 566 John Deere Round Baler

This instructional video is shot by a farmer in the cab. He details the control monitor panel, and highlights the most used features of the baler. He not only explains, but shows you the results as he moves along. A great video of how to properly operate this baler.

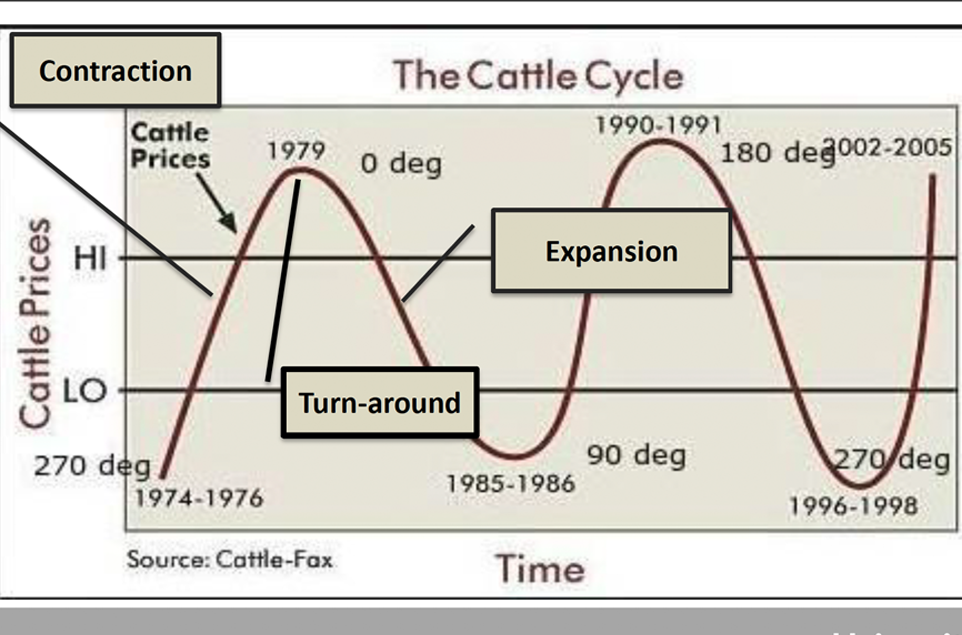

Supplementary Cattle Learning Modules

Read these documents to learn more about cattle production

Key Beef Cattle Marketing Concepts

For managers of beef cattle enterprises marketing means two things. First, it is using market information, and then getting the most out of the cattle that are sold and to pay the least for cattle and other purchased inputs.

Using Cattle Psychology To Proper Handle Cattle

Proper handling of beef cattle requires knowledge of cattle behavior and the presence of adequate handling facilities with sufficient fencing, watering, and feeding to allow you to utilize recommended management procedures.

Missouri Beef Value-Added Study

Profitability in growing and finishing beef cattle depends primarily on the cost of producing gain and the value of that gain. The value of gain per pound is the difference between an animal's purchase price and its sales value divided by the gain added.

Beef Cow Joint Agreements

Since owning cattle involves a relatively high capital investment, many cow-calf enterprises are carried out jointly by two or more people. One party may own the breeding herd while another party supplies the labor to take care of them.

Estimated Costs for Livestock Fencing

Fencing costs are one of the most expensive aspects of livestock grazing. The type of fence greatly impacts the cost per foot, total cost, and annual ownership cost. The shape of the paddocks affects theamount of materials needed and labor required.

Ranchers Annual Agriculture Leasing Handbook

Whether a person owns land or is seeking to find land to rent, leasing property for grazing or hunting leases can be beneficial for both parties. Similarly, both the owner and lessee of livestock benefit from lease agreements as well.

Health and Management Techniques

A healthy, disease-free herd is a goal for all beef producers.Your herd health program will be most successful when youand your veterinarian customize it to your herd’s needs. Plan a program that prevents diseases and disorders.

Feeding the Cow Herd Is One of the Biggest Costs

Feed is the biggest single cost of maintaining the beef herd. You must meet the nutrient needs if you want to obtain a high percent calf crop with heavy weaning weights in a short period of time. However, you should meet these nutrient needs in a cost effective manner to achieve profitability.

Contact Details

If you have any quetions or need help with anything, feel free to get in touch with our amazing team.

Location

28, Blocs City, BL12345 USB

Phone

If you want, you can place some other information or contact details here.

Copyright © 2021 Blocs Templates