Northeast Iowa Cattlemen Hedge Using Risk Management Tools. (Front row l to r) Jake Gerlach, Jeff Gerlach and Nate Gerlach. (Back row l to r) Chris Homan, Colton Homan.

By Erin Lawburgh

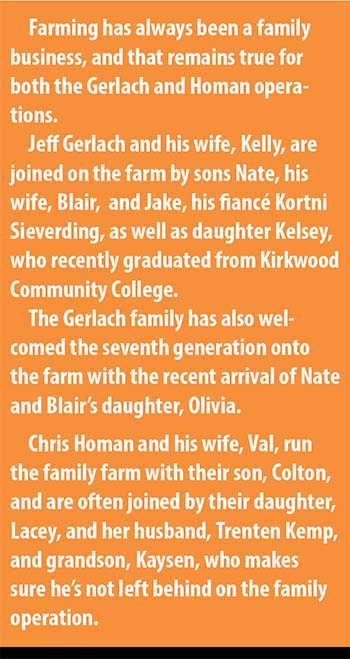

Farming in northeast Iowa for over 170 years, the Gerlachs have learned the importance of adapting to the evolving landscape of agriculture. With the original Gerlach family settling near Bellevue in 1855, Jeff Gerlach and his sons, Jake and Nate, are fifth and sixth generation farmers that are continuing the legacy that was handed down to them.

“I can remember back when we had old four-row corn planters, and before that my family farmed with horses,” Gerlach recalled. “We used to cut with a seven-foot sickle mower mounted on the back of a tractor in the late ‘60s and ‘70s. Now we’re using a 14-foot discbine.”

With a continual eye on growing the operation, Gerlach owns 1,100 acres and farms additional custom ground. Along with row-crops, he runs 100 cows and finishes 1,000 head a year.

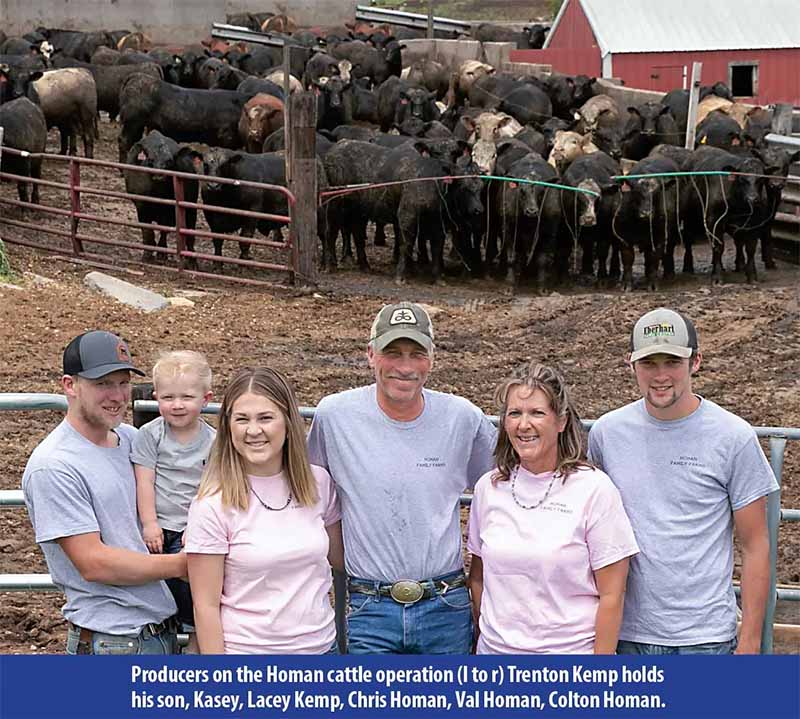

Chris Homan has also weathered the changing tides of the agricultural economy. Located just south of Bellevue, Homan took over the dairy farm that his dad began back in the ‘50s, peaking at 80 to 90 head before he decided it was time to transition the operation to beef cattle in 2004.

“The regulations were getting stricter,” Homan recollected. “The way I was set up, I would have had to spend a lot of money to make things work.” Today, Homan farms between 1,800 and 2,000 acres in addition to running a 225 head cow-calf operation and managing 350 to 400 head of feeder cattle with his son Colton.

Hedging Against The Odds

Farming has often been branded as a gamble due to high input costs and unpredictable market swings. Today’s top dollar gain may turn into tomorrow’s market crash. “There’s more risk now than there used to be,” Gerlach commented. “It seems like you have to continuously expand, or you’ll fall behind. It’s hard to keep going unless you’re constantly getting bigger.”

With narrow profit margins that can suddenly be engulfed by unforeseen market downturns, Gerlach and Homan had to determine how to battle against guaranteed price volatility. “I knew I had to protect myself,” Homan said. Homan was first introduced to the concept of hedging as a marketing strategy while operating his dairy. At that time, he sold all his cull cows through National Farmers Organization, which opened the door for him to explore price risk management tools for his operation.

“It’s about holding all your money together,” Homan advised. “You can’t control the future. At least if you’re hedging, you’ve got your bottom line. You might not always make money, but you might save yourself from losing in the long run. Like I’ve been told, if you’re not losing money, then you’re making money. Them minus signs, they leave marks.”

Gerlach has only recently started hedging his feeder cattle to combat price risk, but during the past four to five years, he’s grown more confident in hedging compared to other forms of price risk management. “I like hedging better,” Gerlach stated. “It takes the risk away, and it’s cheaper than livestock insurance. While some guys like the contract, then you’re locked in with one plant.”

When it comes to hedging his cattle, Gerlach prefers the flexibility in working with various packing plants as well as the opportunity to secure a higher bid. But most of all, he values how hedging has minimized the impact that turbulent markets have on his bottom line.

“I guess what really nailed it for me is when Covid happened,” Gerlach shared. “I wasn’t doing much of it then, but just before Covid hit, I hedged four loads at different periods, and then we had the market crash. They were picking up a $30 premium because I had hedged them at $1.27 instead of 90 to 95 cents.”

Gerlach hasn’t looked back since. Although eliminating risk is impossible, he realized he wasn’t at the mercy of whatever today’s local cash market might be. “Even nowadays I’ll hedge a load, and if I think it’s that high, if the market stumbles a bit, I can get out of it,” Gerlach explained. “I’m still committing the cattle but picked up the difference between my hedge and my cash.”

Hedging For The Future

Without a crystal ball to see the future, Homan and Gerlach have both taken initiative to study market trends for themselves to better understand the hedging process. For Homan, the most effective strategy to learn hedging simply came by doing it. “I’m a hands-on guy,” Homan commented. “Until I do it, I don’t quite understand it. I’ve learned the routine of a few steps, but I’ve had to go through a few hiccups to make it work.”

While Homan has spent many years hedging cattle, the learning never ends. Although hindsight won’t offset lost opportunities, it becomes a valuable training tool. “Even in the last year, I’ve done some hedging on cattle I’ve bought and haven’t done it on others I’ve had, and I’ve realized I’ve got to do it all at once,” Homan shared. “I could have been in a lot better position if I’d done what I should have done instead of waiting.”

As Gerlach has gained additional experience with hedging, he’s learned to keep an eye on the Board of Trade while reviewing various articles and listening to podcasts to better target peaks in the market. Reflecting on what he would do differently if he could change his approach, he wishes he would have studied hedging sooner than he did.

“I keep learning as I go,” Gerlach said. “You hope you make the right decision, but it can be a complicated issue.”

Despite the learning curve that comes with hedging, Gerlach and Homan are both looking ahead. In an industry that doesn’t often offer second chances, they both know that utilizing tools to manage risk is the most sustainable way to ensure they will be able to pass on the family business of farming to the next generation.

Hedging their livestock has become a crucial marketing tool in planning for the future and adapting to the changing landscape of farming. “If you’re going with the local cash market, there’s no protection there, and you’re stuck with whatever the cash market is today,” Gerlach reiterated.

“With hedging, I can take some of the risk out of it. They always claim there’s risk involved with hedging, but I think in the long run I’ve come out ahead.”