National Farmers Crop Insurance

By Denice Rackley

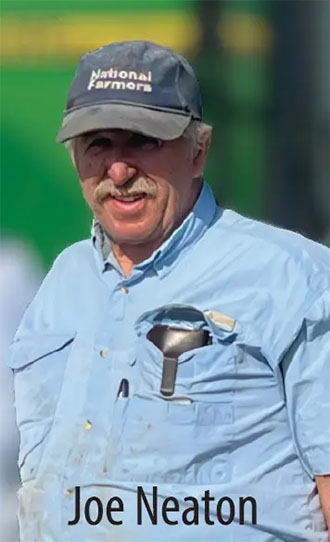

In 1975, a young farmer from Watertown, Minnesota began his farming career. Born and raised on a dairy farm, his family has been a part of National Farmers since the early 1960s.

Through his nearly 50 years of membership, he has produced dairy, grain and livestock commodities, and marketed them through the organization. He is now solely focused on growing grain.

When National Farmers began offering its crop insurance program to producers in 2008, Neaton paid attention. Once he took out his first policy with National Farmers, he hasn’t looked back. “Some years we haven’t used the crop insurance, but the years we have, it has saved the farm more than once,” said Neaton.

Congress first authorized the federal government to assist agriculture producers in the 1930s due to the Great Depression and Dust Bowl. In 1938, the Federal Crop Insurance Corporation (FCIC) was formed to manage the initial experimental assistance program.

Then, in 1980, the Federal Crop Insurance Act expanded the program to include more crops and more regions of the country.

In 1994, the government once again made changes, passing new farm insurance legislation, the Federal Crop Insurance Reform Act, which stipulated mandatory participation for producers who wished to apply for any other government crop assistance programs.

“Each year sees additional adjustments to the insurance regulations and available options,” said National Farmers Crop Insurance agent, Al Smith. “Crop, pasture, and forage insurance and livestock risk policies protect farmers against loss and market risk, helping them maintain financial stability,” Smith emphasized.

The Pasture, Rangeland and Forage (PRF) insurance protects grazers and those who sell hay as a commodity. Basically, it’s a rain insurance policy, Smith said, but crop insurance is by far the most widely used option.

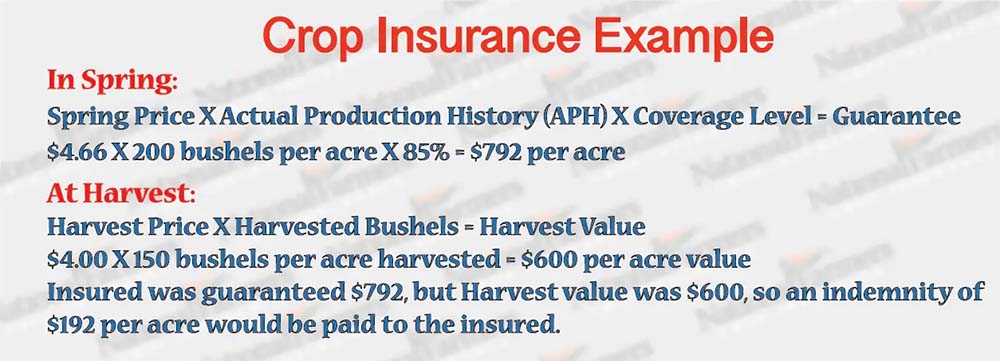

Revenue Protection (RP) and Yield Protection (YP) are the two main types of crop insurance shielding farmers against market price decreases and lower-than-normal yields. Both of which rely on location-specific and board-of-trade information.

Choosing a policy that best suits your operation, completing all the paperwork properly, paying premiums on time, and speaking to your agent in a timely fashion about any potential claims will go a long way in navigating all the regulations associated with insurance policies. But this is where having a great agent comes in, noted Neaton.

“Al is wonderful to work with and always goes above and beyond.” Adamantly disliking all paperwork, Neaton said that Smith always follows up, ensuring everything is in order when deadlines are approaching.

He used to dairy farm and grow crops, but the cattle left a couple of years ago. “My brothers, sons and I farm together, sharing equipment to raise corn, soybeans, and alfalfa. We all have crop insurance with National Farmers and work with Al.”

This year, the incredibly wet spring delayed planting. “There was no way we could get into several fields. My sons had about 200 unplanted acres, my brothers had 50 and I had 25 acres. We contacted Al, who sent someone out to look at the fields and were eligible for payment.”

With the requirement of planting a cover crop on these unplanted acres, Neaton planted alfalfa. The alfalfa is perfect for him since they can harvest it for the next few years.

Rain has continued to fall this year and may impact yields. “It began to dry out in August, but the excess moisture may have significantly lowered soybean yields. We may have a claim based on yield reduction, but we won’t know till we get in there.”

Visit nationalfarmers.com and click on the risk management grain link.